Table of Contents

ToggleAllsums SIP Calculator 2025 Review: Key Features That Make It the Best Choice

In today’s rapidly changing financial landscape, Systematic Investment Plans (SIPs) have become the preferred strategy for millions of Indian investors aiming to build long-term wealth with discipline and simplicity. But before you start investing, you need a dependable way to estimate your returns, plan your goals, and understand your investment journey—and that’s where an SIP calculator becomes essential.

While numerous SIP calculators are available online—from banks like ICICI and Axis to fintech platforms such as Groww, Angel One, and ClearTax—not all tools are equally effective. After a thorough comparison of top SIP calculators in India, one platform stands out as the leading choice in features, user experience, and educational value: Allsums’ SIP & Lumpsum Investment Calculator.

Here’s why Allsums isn’t just another calculator—it’s your intelligent, adaptable, and future-ready financial planning partner.

Allsums SIP calculator Advantages over others

1. Four Investment Strategies in One Tool—No Competitor Comes Close

Most SIP calculators, including those from Groww, ICICI Bank, and Axis Bank, only support basic monthly SIPs. Some, like Angel One and ClearTax, offer a lump sum option, but you need to switch between different tools or tabs.

Allsums SIP calculator goes far beyond. With four integrated investment modes, you can quickly model real-life scenarios.

- Standard SIP: Fixed monthly contributions.

- Lump sum: One-time investment with growth projection.

- Step-Up SIP: Automatically increases your SIP amount yearly (e.g., 10% hike with each salary raise).

- Hybrid: Combines an initial lump sum with ongoing monthly SIPs—ideal for windfalls like bonuses or inheritance.

This flexibility reflects how people really invest. However, none of the major competitors provide Step-Up or Hybrid modelling—a notable gap for goal-based planning.

💡 Example: Want to invest ₹5 lakh today and ₹10,000/month for your child’s education? Only Allsums lets you calculate that in one go.

2. Global-Ready: Multi-Currency Support for NRIs and International Investors

Allsums SIP calculator supports INR, USD, EUR, and GBP—a rare and powerful feature in a market dominated by India-only tools.

Platforms like SBI Securities, ICICI, and Finology are strictly INR-based. Even Angel One and Groww, despite their global user base, don’t offer currency switching.

For NRIs, expats, or anyone managing cross-border finances, this makes Allsums uniquely practical. You can plan your Indian SIPs while thinking in dollars or euros—no manual conversions needed.

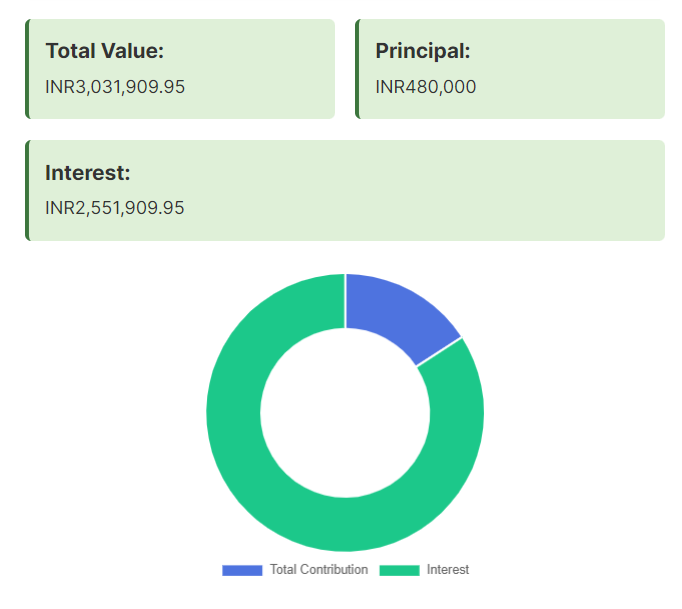

3. Visual Learning: See Compounding in Action with a Doughnut Chart

Numbers alone don’t inspire. But seeing your wealth split between “your money” and “market gains”? That’s powerful.

Allsums SIP calculator includes an interactive doughnut chart that instantly shows:

- Principal Invested (your actual contributions)

- Estimated Returns (the magic of compounding)

This visual breakdown helps users—especially beginners—grasp how time and consistent investing multiply wealth. In contrast, Groww, ClearTax, ICICI, and Axis Bank show only raw numbers. Angel One and Finology offer minimal or no visuals.

Why it matters: When you see that 70% of your ₹1 crore corpus came from returns—not your savings—you’re more likely to stay invested through market dips.

4. Save, Share, and Plan: Export Your Results as PDF

Allsums SIP calculator lets you export your entire calculation—including inputs, results, and the visual chart—as a PDF. This is invaluable for:

- Sharing with financial advisors

- Tracking progress over time

- Including in personal finance journals or family planning sessions

Shockingly, not a single competitor (not even ClearTax or Angel One) offers this feature. Their tools are “use-and-forget”—great for quick estimates, but useless for serious planning.

5. Educational, Not Just Transactional

Many SIP calculators feel like cold, mechanical tools. Allsums SIP calculator, however, guides you with context:

- Recommends realistic return assumptions (10–12% for equity funds)

- Explains inflation’s impact on future purchasing power

- Provides goal-based examples: retirement, child education, home down payment

Compare this to ICICI or Axis Bank, which offer bare-bones inputs and outputs with zero guidance. Even ClearTax and Angel One, while informative in their blogs, keep their calculators purely functional.

Allsums bridges the gap between calculation and comprehension—making it ideal for first-time investors.

6. Clean, Intuitive Design That Works on Any Device

User experience matters. Allsums SIP calculator uses a tab-based interface that’s:

- Mobile-responsive

- Clutter-free

- Instantly understandable

In contrast:

- Finology’s calculator feels outdated and text-heavy.

- SBI Securities and Axis Bank use dense layouts with poor visual hierarchy.

- Groww and ClearTax are better but still lack the polish and clarity of Allsums.

For users who aren’t finance-savvy, this simplicity reduces anxiety and encourages action.

7. Truly Neutral—No Product Push or Hidden Agenda

Here’s a crucial but often overlooked point: Allsums doesn’t sell mutual funds, insurance, or brokerage services. It’s a pure financial education and planning tool.

Meanwhile:

- Groww, Angel One, ICICI, Axis, and SBI Securities are all financial platforms using their calculators as lead-generation funnels.

- Their tools often nudge you toward their own funds or services—even if they’re not the best fit.

Allsums SIP calculator remains 100% unbiased, giving you freedom to plan without pressure.

Allsums SIP calculator's Real-World Use Case: Planning for Your Child’s Education

Imagine you want to save ₹60 lakhs for your child’s university in 16 years.

- On Groww or ICICI, you’d input a monthly SIP amount and see the result—but you can’t factor in a future bonus (lump sum) or annual salary hikes (Step-Up).

- On Allsums, you could:

- Start with a ₹2 lakh lumpsum today

- Add a ₹15,000/month SIP

- Increase it by 8% yearly

- See the total corpus in INR or USD

- Export the plan as a PDF to review with your spouse

This level of personalization and realism is unmatched.

Final Verdict: The Best SIP Calculator for Smart Investors

While every SIP calculator helps estimate returns, Allsums SIP calculator delivers a complete financial planning experience. It’s the only tool that combines:

- Multiple investment strategies.

- Multi-currency support.

- Visual compounding insights.

- PDF export for real-world use.

- Educational guidance without bias.

- Sleek, beginner-friendly design.

In a market flooded with basic, transactional calculators, Allsums stands out as the thinking investor’s choice—whether you’re a student starting with ₹500/month or an NRI planning cross-border wealth.

Ready to Take Control of Your Financial Future?

Don’t settle for a calculator that crunches numbers. Use a tool that teaches, empowers, and adapts to your life.

👉 Try the Allsums SIP Investment Calculator today:

https://allsums.com/sip-systematic-investment-plan-calculator/

Plan smarter. Invest wiser. Grow confidently.