The Indian government introduced changes to the income tax slabs in the latest Union Budget for the Financial year 2025-26 to relieve taxpayers’ burdens and improve economic growth. These changes benefit middle-class citizens by increasing their net disposable income and encouraging them to spend.

Table of Contents

ToggleWhat are India’s income tax slabs for AY 2025-26?

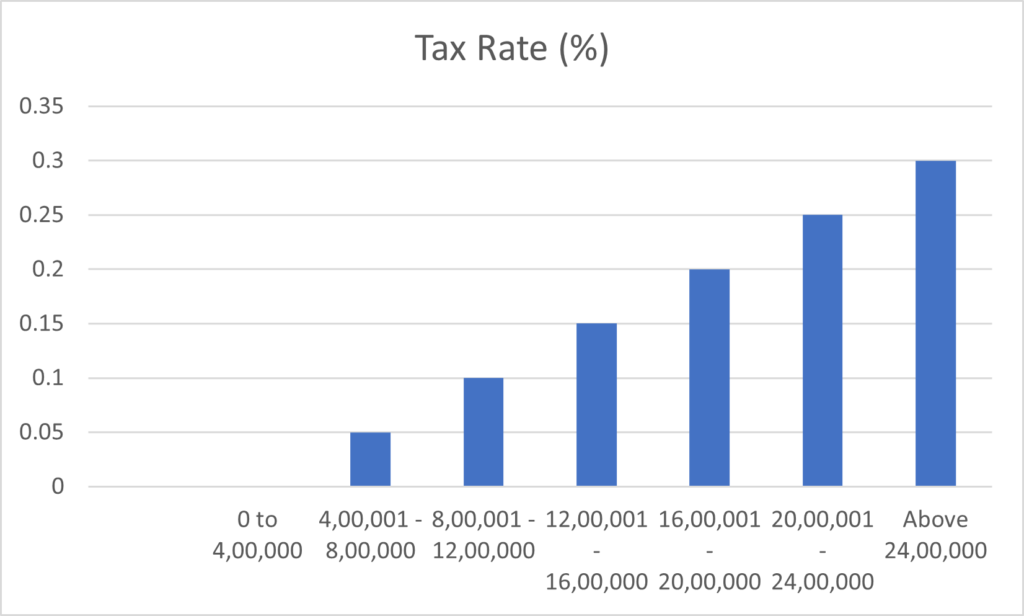

The following graphs show the latest income tax slab rates.

As shown in the graph above, the new tax regime, introduced to simplify taxation, has undergone revisions in the 2025 budget. It offers lower tax rates with limited exemptions and deductions. Here are the updated slabs:

| Annual income (₹) | Tax Rate |

|---|---|

| Up to ₹4,00,000 | 0% |

| ₹4,00,001 – ₹8,00,000 | 5% |

| ₹8,00,001 – ₹12,00,000 | 10% |

| ₹12,00,001 – ₹16,00,000 | 15% |

| ₹16,00,001 – ₹20,00,000 | 20% |

| ₹20,00,001 – ₹24,00,000 | 25% |

| Above ₹24,00,000 | 30% |

For more information about income tax slabs, please visit https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-1.

Understanding India’s Income Tax Slabs

Income tax slabs represent different income ranges classified for taxation purposes, with specific rates assigned to each range. As earnings increase, so does the tax rate on any additional income.

For instance, under the New Tax Regime for FY 2025-26, if your annual income is up to ₹4 lakh, you don’t have to pay any tax. However, if your income falls between ₹4 lakh and ₹8 lakh, you will pay a 5% tax on exceeding ₹4 lakh. Similarly, higher income brackets, such as ₹8–12 lakh and ₹12–16 lakh, are taxed at increasing rates of 10% and 15%, respectively. This system ensures that lower-income individuals pay a lower tax rate while those earning more contribute a larger share. Salaried individuals also benefit from a standard deduction of ₹75,000, reducing their taxable income. By dividing income into slabs, the tax system becomes fairer and easier for everyone to understand.

Key Highlights of the New Tax Slabs announced

- Increased Tax Exemption Threshold: The Indian government announced its plan to increase the tax-free income limit to 12 lakh rupees under the new tax regime. The previous limit was 7 lakh rupees. This change should allow more individuals to save on taxes.

- Lower Tax Rates: The revised tax slabs will reduce the tax burden on middle-class taxpayers, providing them with more discretionary income. This new regime will provide taxpayers with greater financial freedom and increase their purchasing power, thereby creating increased demand for goods and services in the market.

- Standard Deduction Continued: Under the new tax regime, the standard deduction of ₹75,000 for salaried individuals and pensioners continues.

- Encouragement for New Regime: The new tax regime offers taxpayers numerous benefits, so the government wants to make it the default system.

Conclusion

The latest changes in the tax slab reduce the tax burden and improve the country’s economy.

If you want support to file your income tax return, you can contact us at https://allsums.com/contact/