Table of Contents

ToggleSIP calculator with step-up : Your Ultimate and Best Financial Co-Pilot

Introduction

Planning for your child’s education, a dream home, or a worry-free retirement? You’re not alone. Millions of Indian investors use Systematic Investment Plans to build wealth—but most rely on oversimplified tools that ignore real-life variables like salary hikes, lump-sum bonuses, or inflation.

That’s where the Allsums SIP & Lumpsum Investment Calculator changes the game. It’s not just another “Systematic Investment Plans return calculator.” It’s a smart, flexible, and free financial planning tool designed for how people actually invest.

In this guide, you’ll discover:

- Why a Step-Up SIP can double your wealth vs. a regular Systematic Investment Plans

- How to combine lumpsum + Systematic Investment Plans for faster goal achievement

- How to use the calculator to beat inflation and match your investments to your rising income

- And how to turn vague dreams into clear, visual, and actionable financial plans

Why Most SIP Calculators Fall Short (And What to Use Instead)

A standard Systematic Investment Plans calculator assumes you’ll invest the same amount every month for 20+ years. But in reality:

- Your income grows (thanks to promotions or raises)

- You receive annual bonuses or windfalls

- Inflation erodes purchasing power (5–6% per year)

SIP | First-time investors, disciplined savers | Rupee-cost averaging, low entry barrier |

Lumpsum | Bonus recipients, inheritance, sale proceeds | Maximize compounding on large one-time sums |

Step-Up SIP | Salaried professionals with annual hikes | Automatically scale investments with income |

Hybrid | Investors with existing savings + monthly cash flow | Combine immediate capital + long-term discipline |

Plus, you can run all calculations in INR, USD, EUR, or GBP—ideal for NRIs or global investors.

Real Example: How a Step-Up SIP Doubles Your Retirement Corpus

Let’s compare two investors saving for retirement over 25 years, assuming a 12% annual return (a realistic long-term average for equity mutual funds):

Standard SIP (Fixed ₹10,000/month)

- Total invested: ₹30,00,000

- Projected corpus: ₹1.90 Crores

Step-Up SIP (Start at ₹10,000, increase by 10% yearly)

- Total invested: ₹98.5 Lakhs

- Projected corpus: ₹4.45 Crores

💡 That’s a 134% higher final value—just by aligning your SIP with your expected salary growth.

This is the power of dynamic investing, and the Allsums calculator makes it effortless to model.

The Real Magic? Scenario Planning That Changes Everything

Let’s put this into practice with a real example: retirement planning over 25 years.

The “Set-and-Forget” SIP (What Most People Do)

- Monthly SIP: ₹10,000

- Annual return: 12%

- Tenure: 25 years

Result:

- Total invested: ₹30 lakhs

- Final corpus: ₹1.90 crores

Not bad, right?

The Step-Up SIP (What Smart Investors Do)

Now, imagine you increase your SIP by 10% every year—a realistic match for annual salary hikes.

- Initial SIP: ₹10,000

- Annual step-up: 10%

- Annual return: 12%

- Tenure: 25 years

Result:

- Total invested: ₹98.5 lakhs

- Final corpus: ₹4.45 crores

That’s more than double the wealth—just by letting your investments grow with your income.

This isn’t theory. It’s math you can trust, and the Allsums calculator shows it to you in seconds.

How to Use the Allsums SIP Calculator: A Step-by-Step Walkthrough

- Go to the Allsums SIP & Lumpsum Calculator

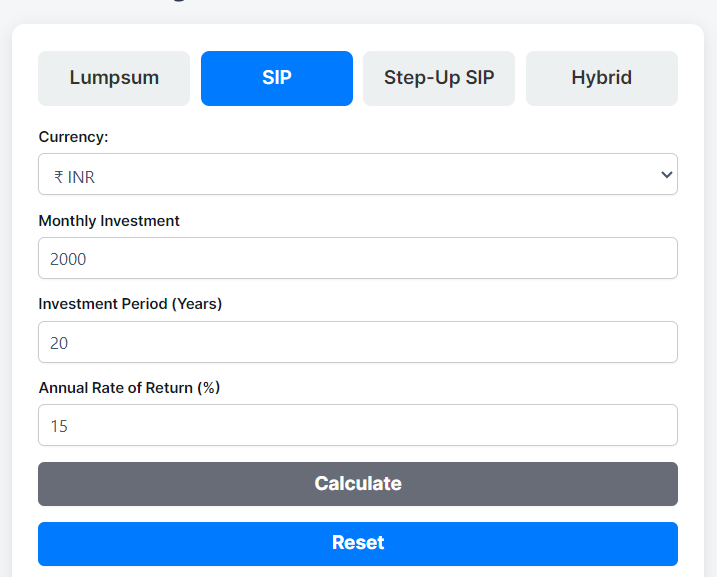

- Select your investment type: SIP, Lumpsum, Step-Up SIP, or Hybrid

- Choose your currency (INR, USD, EUR, GBP)

- Enter your details:

- Monthly amount (or lumpsum)

- Investment tenure (in years)

- Expected annual return (10–12% recommended for equity)

- For Step-Up SIP: Add your annual increase percentage (e.g., 10%)

- Click “Calculate”

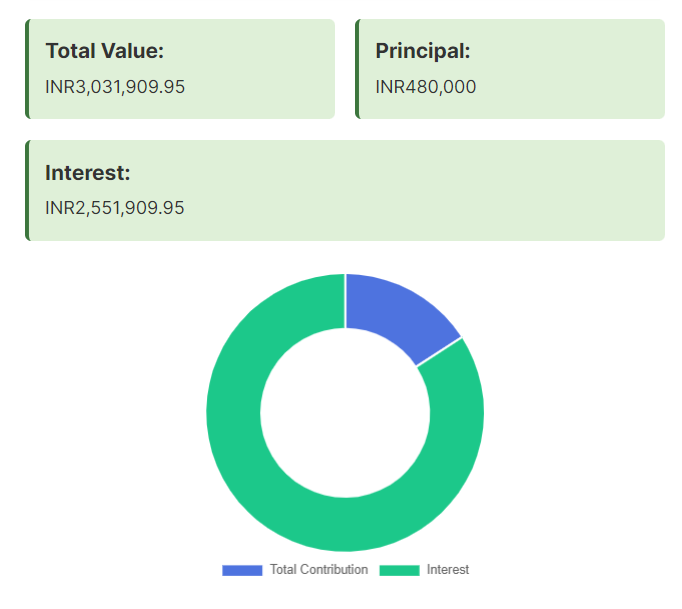

You’ll instantly see:

- Total Value (your projected corpus)

- Principal (total amount invested)

- Interest/Gains (wealth created by compounding)

- A doughnut chart visualizing your principal vs. returns

✅ Pro Tip: Use the “Export to PDF” feature to save or share your plan with family or a financial advisor.

Final Thought: Don’t Let Inflation Steal Your Dreams

A static SIP might feel safe, but it’s often not enough in a world where prices rise every year. The smart move? Let your investments grow as you do.

The Allsums SIP Investment Calculator gives you the clarity to:

- Test multiple scenarios

- Adjust for real-life changes

- Visualize your path to financial freedom

And the best part? It’s 100% free, no signup required, and works instantly in your browser.