Table of Contents

ToggleSystematic Withdrawal Plan: Best and Efficient Way to Generate Stress-Free Monthly Income

In a world where economic stability feels like a moving target, generating a reliable, consistent income without completely draining your savings is the holy grail for retirees, long-term investors, and anyone seeking passive cash flow in India.

If you’ve heard of the Systematic Investment Plan (SIP)—the popular tool for building wealth—it’s time to meet its equally powerful, but often overlooked, counterpart: the Systematic Withdrawal Plan (SWP).

An SWP is a genius financial strategy that turns your investment corpus, typically in mutual funds, into a regular, steady income stream. It’s the ultimate tool for financial freedom, helping you enjoy your savings while keeping the rest of your money invested and growing.

In this clear, human-friendly guide, we’ll demystify the SWP, show you exactly how it works, highlight its significant benefits (especially its tax efficiency in India), and—most importantly—introduce you to the essential tool you need for planning: the AllSums SWP Calculator.

What Exactly Is a Systematic Withdrawal Plan (SWP)?

Simply put, the SWP allows you to withdraw a fixed amount of Indian Rupees (₹) from your mutual fund investments at set, regular intervals—usually monthly, quarterly, or annually.

Think of it as the “reverse SIP”:

SIP: You regularly put in small amounts to build a large corpus.

SWP: You start with a large corpus (like your retirement nest egg) and regularly take out a small amount to cover your living expenses.

Instead of panic-selling your entire portfolio, the SWP provides a disciplined, predictable income while the remaining capital stays invested, continuing to earn returns in the market.

How Does the Systematic Withdrawal Plan(SWP) Mechanism Work?

Setting up an Systematic Withdrawal Plan is easy—you instruct the mutual fund house to redeem (sell) units equal to your chosen fixed amount on a specific date each month (or quarter).

For example, if you’ve invested ₹60 Lakhs and set a monthly withdrawal of ₹40,000:

- On your chosen date, the fund house automatically sells units worth exactly ₹40,000 from your holdings.

- It then instantly transfers the cash to your bank account.

- Meanwhile, the vast majority of your remaining units stay invested, continuing to compound returns.

The brilliance of this approach lies in the Net Asset Value (NAV). When the NAV is high, the fund house sells fewer units to meet your ₹40,000 withdrawal; when the NAV is low, it sells more units. This disciplined, systematic selling helps protect your core capital from significant market swings.

The Undeniable Benefits of Choosing an SWP in India

An SWP (Systematic Withdrawal Plan) does far more than let you withdraw money—it actively delivers a tax-efficient stream of passive income in India, outperforming many traditional income sources.

Consider how different income sources are taxed:

- Fixed Deposit (FD) Interest: The bank adds this interest to your total income, and you pay tax on it at your marginal income tax rate—up to 30% plus cess.

- Rental Income: The government taxes this at your marginal income tax slab rate as well.

- SWP from Equity Funds (held over 1 year): Only the capital gains portion of your withdrawal gets taxed. Since it qualifies as Long-Term Capital Gains (LTCG), you pay just 10% tax on gains exceeding ₹1 lakh in a financial year.

The Bottom Line: With an SWP, you can significantly lower your effective tax rate compared to FD interest. What’s more, individual resident investors typically face no Tax Deducted at Source (TDS) on mutual fund redemptions—giving you greater control and smoother cash flow.

The Critical Risk: Why Planning Your SWP is Essential

A Systematic Withdrawal Plan is a powerful financial tool—but you must never treat it like an ATM. Without careful planning, you risk depleting your corpus far too soon.

Debunking the Safe Withdrawal Myth: Many investors apply the famous “4% Rule” from the U.S., but this approach often proves too aggressive for India’s economic reality, where inflation has historically run higher. Financial experts actively recommend a more conservative Safe Withdrawal Rate of 3% to 3.5% to help your portfolio last throughout retirement.

Managing Sequence of Returns Risk: If the market crashes during the first few years of your withdrawal phase, it can permanently weaken your portfolio’s longevity. Early losses—combined with ongoing withdrawals—reduce your capital base and limit its ability to recover.

Because of these risks, you must calculate and stick to a precise, rupee-based withdrawal plan. There’s no room for guesswork.

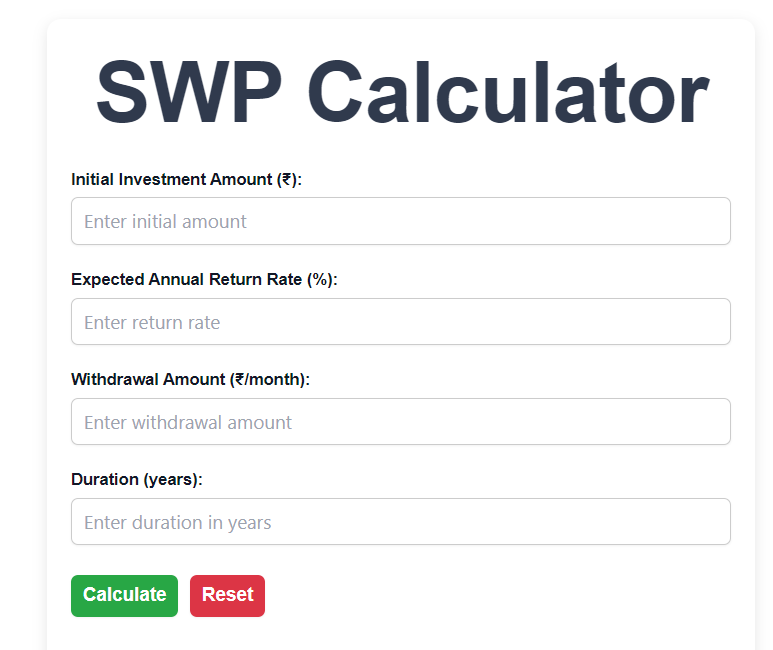

Don’t Guess—Calculate! Use the AllSums SWP Calculator

Stop guessing your monthly income—that’s a sure path to financial stress. Instead, use a powerful tool built for precision.

The AllSums Systematic Withdrawal Plan Calculator acts as your indispensable financial co-pilot. This free, user-friendly tool lets you model multiple SWP scenarios in Indian Rupees, so you can actively determine the right balance between sustainable income and long-term corpus preservation.

What the AllSums SWP Calculator Helps You Achieve

Pinpoint Your Sustainable Income:

Enter your current corpus (₹), expected annual fund return (%), and desired withdrawal duration (in years). The AllSums Systematic Withdrawal Plan Calculator instantly calculates the maximum safe monthly income (₹) you can withdraw without exhausting your funds prematurely.

Model for Inflation:

Since fixed income erodes your purchasing power over time, the AllSums calculator lets you factor in an inflation rate.

Stress-Test Your Financial Plan:

Compare scenarios effortlessly—see how a ₹50,000 monthly withdrawal stacks up against ₹70,000. By adjusting variables like return rate, inflation, or withdrawal amount, you can simulate best-case and worst-case outcomes and build a resilient, adaptable retirement plan.

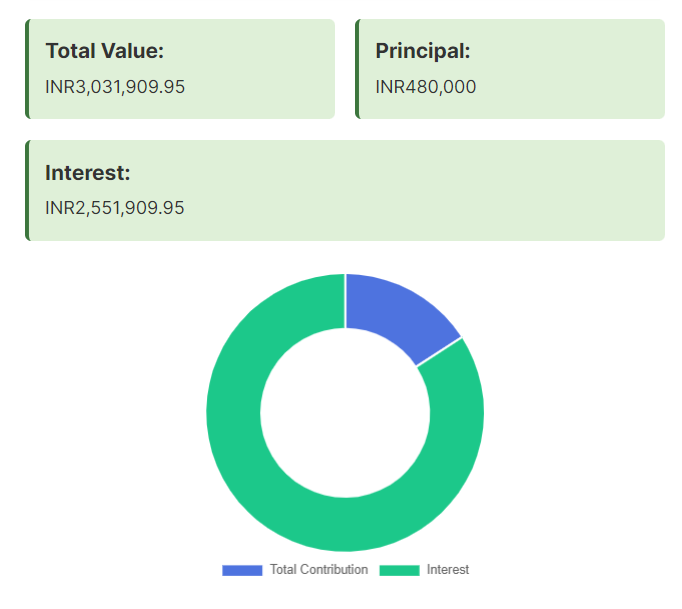

Example: Planning for 20 Years of Income

Let’s walk through a real-world example:

- Current corpus: ₹1 Crore

- Expected annual return: 9%

- Withdrawal duration: 20 years

Using the AllSums SWP Calculator, you’ll see that you can safely withdraw approximately ₹83,000 per month for two decades.

If you attempt to withdraw ₹1,00,000/month instead, the calculator immediately shows your corpus running out several years early—highlighting just how vital precise planning really is.

Your Final Takeaway: Plan Your Future With Confidence

A Systematic Withdrawal Plan (SWP) offers an innovative, disciplined, and potentially tax-efficient way to generate passive income from your mutual fund investments—making it ideal for retirement or any long-term financial goal. But its success hinges on careful planning, realistic assumptions, and alignment with your personal needs and the realities of the Indian economic landscape.

Don’t leave your financial future to guesswork. Use intelligent, purpose-built tools that turn complex retirement math into a simple, visual, and interactive experience. So you know exactly how much you can safely withdraw, for how long, and with what impact on your corpus.

Ready to build an SWP strategy that lasts?

Try the free AllSums SWP Calculator now:

https://allsums.com/swp-calculator/

Don’t let market volatility dictate your expenses. Take control with a smart SWP strategy on m.Stock!

Get Started Today: Download/Visit the m.Stock by Mirae Asset